2 min read

Juan Andrade

Announcing our $2.8m seed round

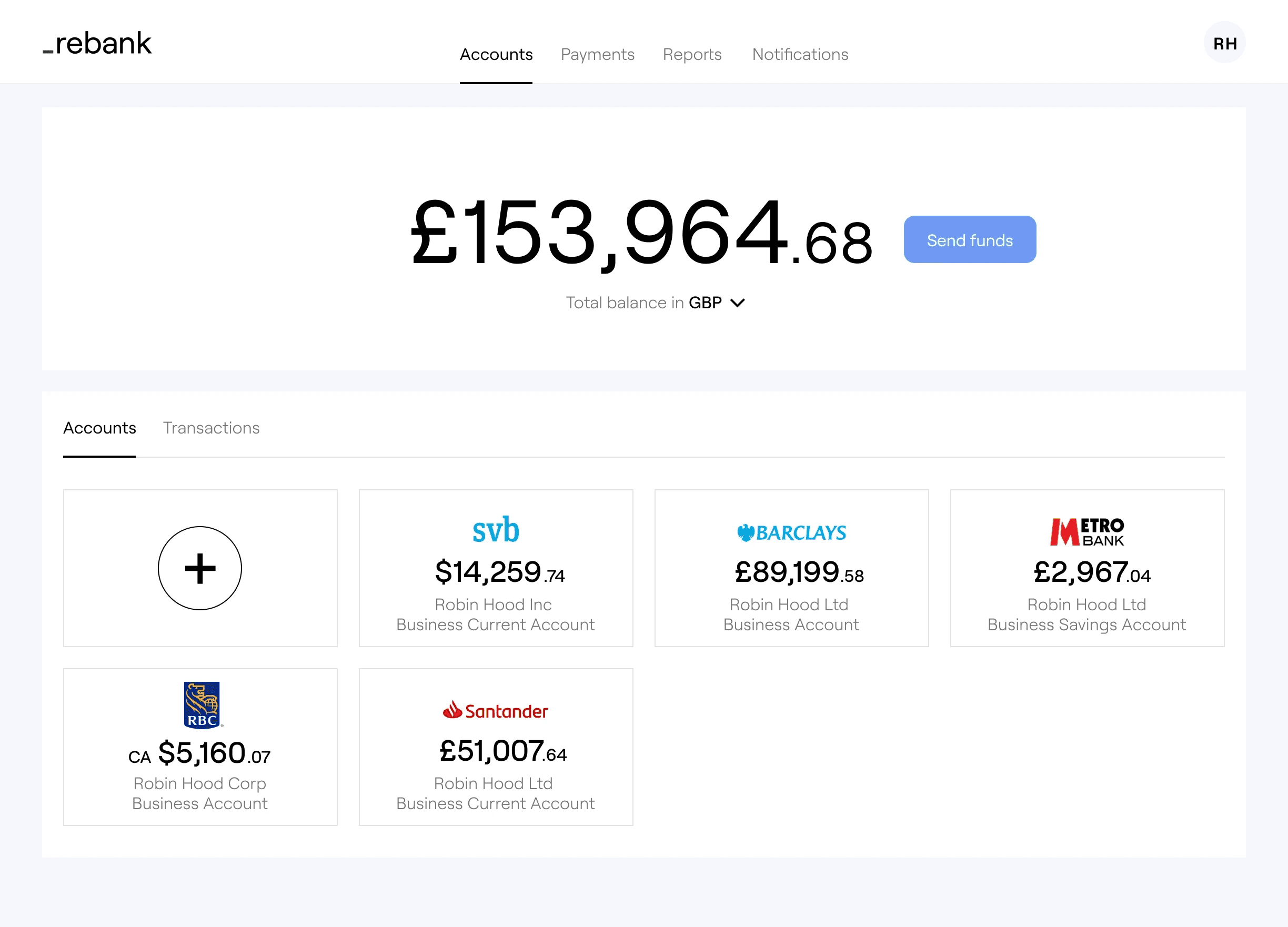

At rebank, we’re building tools that allow founders and managers to speed through their banking workflow — allowing them to change their focus

The next chapter

Thanks to our early customers and investors, we’ll continue to focus on creating a holistic banking experience. We’re following three principles that we believe will help us empower founders and their teams.

Deliver a complete view. Companies want real-time access to their financial data. Not wasting time using static spreadsheets means they can focus on the work that matters. We’ll continue to automate the routine tasks that get in the way of real work.

Optimise for collaboration. As companies grow, they need the tools to help them stay productive. In banking this means shared access, intuitive payment authorisations, and a simpler way to track team activity.

Build seamless experiences, not a bank. There is a void between what legacy banks provide and what their younger counterparts can do. We believe the fastest way to address the needs that growing businesses have is to build a software company, not a bank.

Know someone who needs to read this?

Juan Andrade

Founder, Caribou

Further reading

Our team has worked in the industry for years, and we’re here to share what we have learnt with you.

3 min read

Juan Andrade

29 Jun 2021

How We Got Into Y Combinator (Part 2)

Rebank were invited to YC but didn't make it past the face-to-face interview. We came back from that no to be accepted into the W19 batch

3 min read

Juan Andrade

18 Jun 2021

How We Got Into Y Combinator (Part 1)

There is no formula for getting into YC. Every founding team's story is different to ours, which makes for a diverse group of companies